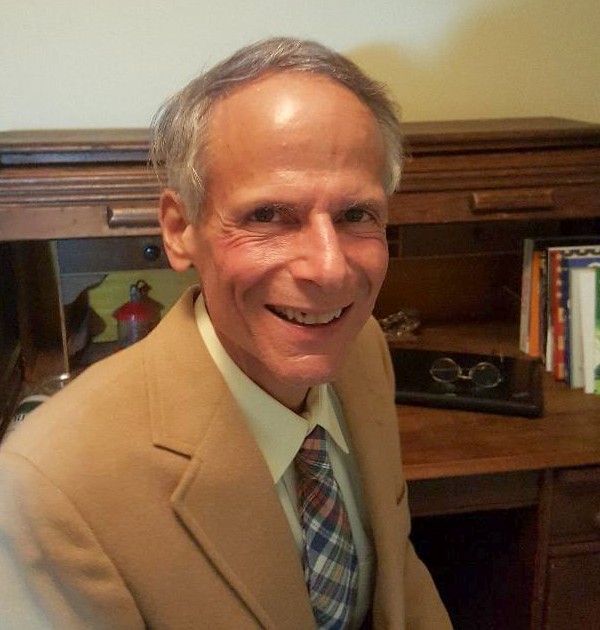

Game Changer Harold Hamm's Mission to Secure Americas Energy Independence

His recent book, “Game Changer,” details his exceptional life story as well as his nearly life-long battle to secure America’s energy independence.

Hamm was born in Lexington, Oklahoma, a town of 2,000 residents, 38 miles south of Oklahoma City. He was the youngest of 13 children, nine of whom still lived at home. His oldest brother was killed in the Battle of the Bulge the previous year. His parents were cotton sharecroppers who often moved from one tenant farm to another, many of which had no running water. As a child, he was always working – gathering eggs, milking the cows or slopping the hogs. While a tough day-to-day existence, the experience taught him hard work, honesty, tenacity and the importance of a close family.

The Hamms moved to Enid, Oklahoma when he turned 16. He saw the area’s oil and gas development and was enamored by the men leading it. They were dynamic and generous, almost larger than life. Many of them, such as Frank and Jane Phillips, Waite Phillips, Sam Noble and the Skellys gave most of their wealth away to make their community and the world a better place. “In Oklahoma, most of the oil people I have ever known fit that same mold,” said Hamm.”

Another early influence was artist John Frank of Frankoma Pottery, who came to speak at a high school assembly. He talked about his love of the arts, but told the students to find something in their lives they could be passionate about and follow that dream.

Hamm did just that. At age 18, unable to afford college but with a wife and small family, he started working in a local oilfield, as an oilfield services contractor. “I literally started at the bottom, cleaning out tanks,” he said. “It was hard, but I was following my dream of someday being an oilman.”

By age 21, he had built up enough credit to buy a tank truck and start his own oil service business. He called it the Shelly Dean Oil Company, named after his two daughters, Shelly and Deana. It would later become Continental Resources. By day, he hauled drilling mud and water to rigs. By night, he studied well logs of the area, searching for opportunities that bigger oil companies had overlooked. Five years later, he drilled his first well, a wildcat well in Alfalfa County, Oklahoma. It produced 20 barrels an hour, a good start. His second well came in at 75 barrels an hour, and a third one nearby gauged 100 barrels of oil an hour.

Hamm now was able to enroll in college, which he did at Phillips University, but he didn’t seek a degree.”I just went for the knowledge to develop the skill set in geology, that I used to find more oil and gas” he said.

At the same time, he began hiring talented petroleum engineers, geologists and financial experts, the best and brightest in all aspects of the business. He was building a corporate framework that would grow and prosper, even in times of adversity. It would eventually became a dream team that would go on to change the world.

Hamm especially had fun wildcatting, which is looking for oil in uncommon areas not known to be an oil field. “Sometimes we win, sometimes we’d lose, but there’s nothing quite like it,” he said. “We often felt like Indiana Jones in the oil patch.”

During the late 1960’s and 70’s Oklahoma’s exploration expanded to almost every basin and producing horizon in the state. Using their unmatched technical expertise, adventuresome passion and willingness at times to go against the grain, Hamm’s oil and gas exploration company grew as well. Sometimes their best discoveries came in downturns and in basins that were out of favor.

An example of his company’s uncommon abilities came in the early 1980's, when things were going “too well,” as prices for services kept going up and people were paying months in advance for drilling services. Feeling a downturn was imminent, Hamm exited the drilling business and sold all his eleven rigs to a group of investors for $32 million. It was not long afterwards that Penn Square Bank, Oklahoma’s largest oilfield lender failed, the boom ended, and a decade of bad times engulfed the industry.

Flush with cash, he began purchasing hundreds of wells and production at distressed prices from a full spectrum of companies who were facing bankruptcy. He even repurchased for ten cents on the dollar, the eleven drilling rigs he had sold before the bust. In addition, he began focusing his efforts on finding oil in giant fields. He felt oil would have higher intrinsic value than natural gas in the coming years, a prediction that proved accurate.

Hamm remained optimistic, even though the industry mindset was one of terminal decline. U.S. oil production had fallen to 5 million barrels a day, while Saudi Arabia was producing double that, with a possible capacity of 25 million barrels a day for forty years. Future gas supplies were equally uncertain, due to capital constraints.

However, Continental Resources was experiencing certain large breakthroughs in well-drilling technology. They began experimenting with Horizontal (directional) Drilling (as opposed to the industry standard of vertical drilling), to exploit hard-to-reach reserves under cities and other geographic locations. In Oklahoma, they drilled fifteen horizontal wells in Enid and numerous others in Oklahoma City and Chickasha. and other municipalities.

Hamm’s people quickly realized the revolutionary potential of Horizontal Drilling. A typical vertical well with sixty square feet of wellbore exposure could be increased to twelve million square feet of exposure. “Imagine a straw with lots of holes in it,” he said. “Then turn the straw on its side. This straw now enables us to unlock reservoirs we could not produce vertically.”

Since the 1990’s, Horizontal Drilling has turned unprofitable wells into money makers. It’s made much of the remaining 85% of untapped oil and gas accessible. It has changed the trajectory of energy in America, propelling us to energy independence. Hamm called it one of the top ten technological improvements of the twentieth century – “a game changer,”

Nowhere was this more evident than in the oil fields Continental Resources drilled in North Dakota and western Montana. Using horizontal drilling and their unique ability to hydraulically frack shale oil resources, they became the largest producer in the Bakken, the nation’s premier oil field. When they added major plays in several other premier basins in the United States, Continental became one of the nation’s major oil producers.

It also made Hamm a very wealthy man. His net worth is estimated to be $18.5 billion, making him the wealthiest Oklahoman and the 63rd wealthiest person in the world.

Larger oil companies witnessed these developments and changed their narrow view. In the last twenty years, they’ve jumped in with multi-billion-dollar acquisitions for oil and gas production and for investment in the infrastructure of shale basins.

By 2019, America became the largest energy producer on the planet, to the tune of thirteen million barrels of oil per day and 98 billion cubic feet per day of natural gas.

We went in a few short years from being a net importer of energy to a net exporter. Americans have saved an average of $6000 annually and consumers around the world have saved more than one trillion dollars a year through lower oil and natural gas prices. Plus, carbon dioxide emissions have declined back to 1990 levels, thanks to clean-burning natural gas replacing coal as the electricity generating fuel of choice.

Hamm’s importance doesn’t end there. He’s given generously to causes that improve healthcare and educational opportunities. He collaborated with OU Health to establish the Harold Hamm Diabetes Center, which is committed for finding a cure for this a disease that’s been identified as the largest health crisis of the next generation. He founded the Domestic Energy Producers Alliance (DEPA), which played a major role in lifting the nation’s 40-year ban on crude oil in 2015. He also donated more than $20 million dollars to establish geology and engineering schools in North Dakota, the largest gifts ever given by a non-alumnus. He also made a $50 million gift to establish the Hamm Institute for American Energy at OSU, which has become a center for all things energy.

Much of the book is devoted to his efforts to improve the political climate for sound energy policy. He’s been a severe critic of anti-fossil fuel policies like the “Green New Deal”, the Paris Accords, carbon taxes, fracking bans, offshore leasing bans, over regulation and over reliance on undependable renewables.

In April of 2024, he organized an event at President Trump’s Mar-a-Lago resort among oil industry leaders to raise up to one billion dollars for his 2024 presidential campaign. He’s hoping we return to the Trump energy policies, which helped the U.S. become the dominant oil and gas producer in the world, put millions of Americans to work with good-paying jobs, and allowed consumers to enjoy cheap, plentiful gasoline and diesel fuel.

By the spring of 2020, gasoline cost less than $1.70 per gallon, diesel was just $2.50 a gallon and inflation was only 2 percent. Perhaps we can return to those days, if Trump is reelected in November.

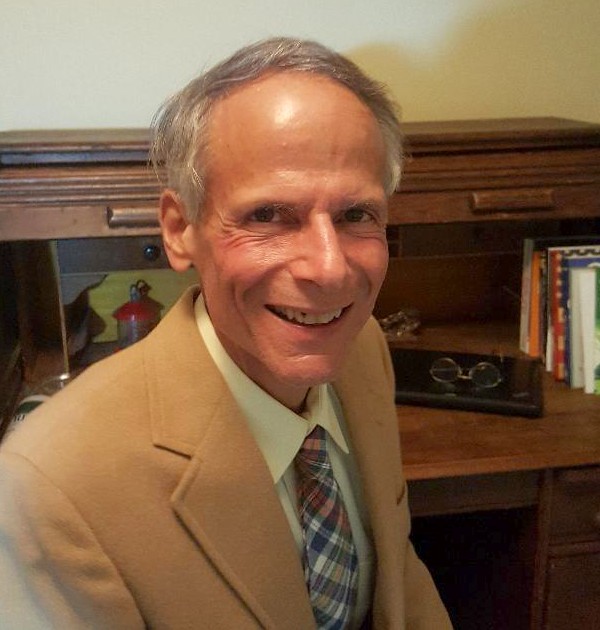

Tim Bakamjian is an independent real estate broker and investor living in Tulsa. He holds a bachelor’s degree in political science from Kenyon College in Ohio and a bachelor’s in journalism from the University of Tulsa. He’s married with one grown child. Political and economic issues have been a life-long interest. He may be contacted at: tbakamjian@gmail.com

Latest Commentary

Thursday 30th of October 2025

Thursday 30th of October 2025

Thursday 30th of October 2025

Thursday 30th of October 2025

Thursday 30th of October 2025

Thursday 30th of October 2025

Thursday 30th of October 2025

Thursday 30th of October 2025

Thursday 30th of October 2025